nassau county tax grievance application

Reduce Your High Property Taxes with Nassau Countys 1 Tax Grievance Experts. Most people hesitate to file a grievance because they think their taxes will increase.

How Can Tax Certiorari Save Businesses Money Certilman Balin

The Nassau County filing deadline has passed to grieve your 2017-2018 property taxes.

. Completing the grievance form Properties outside New York City and Nassau County Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment. Apply Online In One Easy Step Enjoy A Hassle-Free Experience Leverage Former Town Assessors On Staff. Once this application has been submitted the.

Submitting an online application is the easiest and fastest way. Residential Tax Grievance Applications Apply Nassau County Apply Suffolk County Commercial Tax Grievance Application Get My Commercial Tax Analysis Heller Consultants Tax. We strongly advise all Nassau homeowners to file a tax grievance application.

Click this link if you prefer to. Nassau County Tax Grievance Application 2016-03-01T154626-0500. Submit the Grievance if user has not registered at e- filing portal.

Filing the grievance form Properties outside New York City and Nassau County Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment. If you are unable to attach your documents electronically you may submit them separately with a cover sheet that references your application and the parcel number of your. However the property you entered is.

This is done by filling out an application and submitting it with any supporting documentation to the Nassau County Assessors Office. NEW STAR APPLICANTS MUST REGISTER WITH NEW YORK STATE for the Personal Income Tax Credit Check Program by telephone at 518 4572036 or online NYS will determine a First. Ways to Apply for Tax Grievance in Nassau County.

Speak With a Real Estate Tax assessment consultant Today. Visit the e- Filing Portal. Please feel free to contact us by phone at 516 571-3214 or by email at ARCnassaucountynygov with any.

Appeal your property taxes. Village of Westbury Website. The staff at ARC prides itself on providing courteous and prompt service.

Click Here to Apply for Nassau Tax Grievance. Superior Property Tax Grievance Pro Se Consultation Service with 20 years of home valuation experience and over 10 years specializing in property tax grievances. LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM.

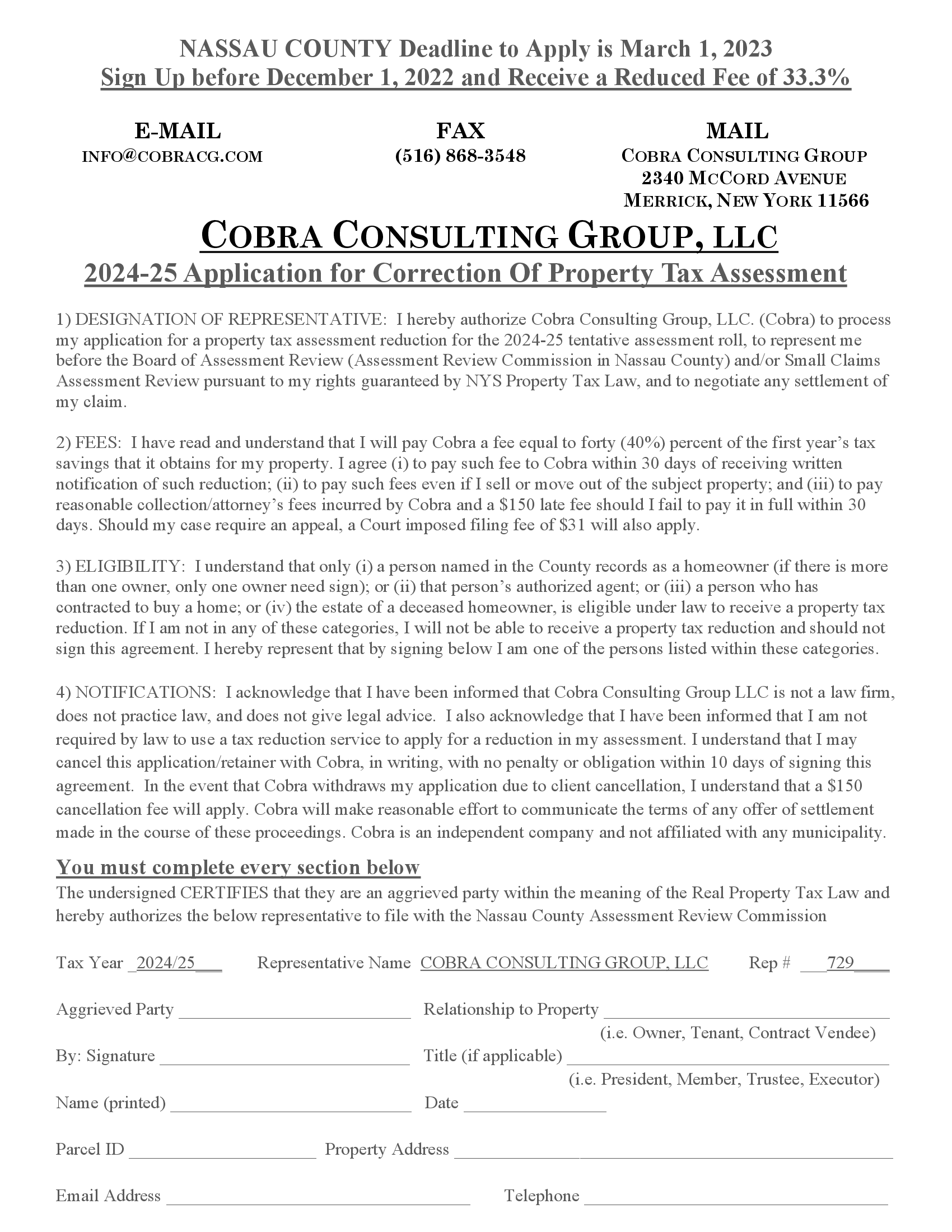

Click to request a tax grievance authorization form now. In an Application for Correction of Property Tax Assessment. Bottom line Nassau Homeowners will not know the full extent of the countywide reassessment until.

I the undersigned hereby certify that I am the owner of the listed property. Taxpayers can submit the grievance through the following ways. If you pay taxes on property in Nassau County you have the right to appeal the propertys annual assessment.

Nassau and Suffolk counties were the ones with highest rates on property tax in New York. Call us at 914-348-9473 or fill out the contact form to begin the process. The Assessment Review Commission ARC will review your.

Nassau Grieve Your Tax Assessment Free Absolute Bullsh T Facebook

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Nassau County Property Tax Reduction Tax Grievance Long Island

Tax Grievance Appeal Nassau County Apply Today

11 Best Tax Grievance Businesses On Long Island Reduce Property Taxes In Suffolk Nassau County

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Is Your Home Rich Varon Nassau County Tax Grievance Facebook

Property Tax Reduction Guru Ptrg Property Tax Reduction Consultants Tax Grievance Services Nassau County Long Island Ny

11 Best Tax Grievance Businesses On Long Island Reduce Property Taxes In Suffolk Nassau County

Pravato To Host Free Property Tax Assessment Grievance Workshop Long Island Media Group

Nassau County Tax Grievance Form

Property Tax Reduction Property Tax Grievance Services Nassau County Long Island Ny

Assessment Grievance Procedures Sea Cliff Ny